In his latest published research, Professor Régis Coeurderoy goes against the flow of false beliefs spread about the few, vulnerable global firms by the Don Quixotes of this world, advocating more research on the topic and even… more globalization!

The recent Alstom-Siemens veto by the European competition authority has raised a wave of furious protestations in business and political circles. Despite EU competition commissioner Margrethe Vestagen’s explanations, French Minister of Finance Bruno Lemaire fiercely expressed his grievances against the decision, arguing that European companies need to become stronger on the global stage. “Let’s have a look at reality — we are facing a huge challenge with the rise of the Chinese industry. What do we do? Shall we divide the European forces, or try to merge the European forces from the industrial point of view”? Bruno Le Maire told CNBC’s Hadley Gamble at the World Government Summit in Dubai. “Often, European companies are competing globally with US or Asian firms that are very strong in their home markets,” commented Peter Altmaier, a close ally of Angela Merkel, in an interview. “So Europe should also allow companies to exist and become global players that are big enough to compete effectively.”

“To be or not to be global, that is the question, we could say. Or maybe we could say: that is not a question any more, because it is a fact!” explains Régis Coeurderoy in an editorial he wrote with Alain Verbeke (University of Calgary, Vrije Universiteit Brussel & University of Reading) and Tanja Matt (Technical University of Munich) for the Journal of International Business Studies. “But are we so sure that globalization, and more specifically corporate globalization, is so much diffused across the world? Or is it more in words and narratives? A closer look at research in international business studies provides a more ambiguous perspective.”

Exploring the widely used and poorly known issue of corporate globalization

“At a macro-level, the concept [of corporate globalization] refers to the growth and broadening scope of international economic exchange relationships of any one country with all other countries around the world, as measured by trade and foreign direct investment (FDI) flows, and other types of exchanges (capital, people, technology, ideas, effective institutional practices),” they write.

It is widely accepted among economic and management scholars that globalization drives net benefits, resulting from lower resource usage per unit of output, and the international diffusion of better industry practices, ranging from high-quality accounting systems to proprietary technologies. Moreover, the globalization of information flows has dramatically increased the worldwide awareness of grand challenges such as climate change impacts. “Unfortunately, in popular narratives spread by many business and political leaders, corporate globalization has been associated with many discontents – mostly devoid of a sound factual but driven by perceptions of alleged, undesirable societal effects such as the rise of inequalities”.

This being said, corporate globalization’s role has primarily been to provide broader geographic access to life-saving medications such as vaccines, as well as medical services (thus being instrumental in creating a public good which has – through supporting human overpopulation – in turn been instrumental to the demise of many other public goods and the rise of several public bads). It has also facilitated the easier distribution of essential goods to serve basic needs, and the diffusion of efficiency-enhancing institutional practices and management methods. “Most negative spillovers of international business activities, apart from highly-visible cases of market power abuse, have largely been caused by ineffective societal institutions, supposed to regulate economic activities but failing to do so”, adds the ESCP Professor in Strategic Management & Innovation.

People who criticize macro-level globalization typically cannot defeat the argument about the net benefits of globalization (with the qualification that inequalities will also materialize, requiring policy measures to improve distributional justice). Like Miguel de Cervantes’s character in The Ingenious Gentleman Sir Quixote of La Mancha, “critics who argue that global firms are a malign presence in host countries and thrive on alleged malevolent decision-making processes are, in fact, battling imaginary enemies. (…) They attack windmills, which they fear are ferocious giants.”

There is, however, a recent de-globalization narrative at the macro-level with negative spillovers at the firm-level, as observed in an article published in The Economist: it predicted the rise of “a more fragmented and parochial kind of capitalism, and quite possibly a less efficient one (…) the infatuation with global companies will come to be seen as a passing episode in business history.”

“But who has, or ever had ‘unreasoned passion’ for the global firm? What exactly are these global companies, supposedly the outcome of a corporate globalization process?” the authors ask before trying to define corporate globalization, thereby showing that it’s not that easy. “A closer look at the reality of corporate globalization shows that fully-fledged global companies were and are still the exception rather than the rule in international business.”

There are far less truly global firms than one imagines

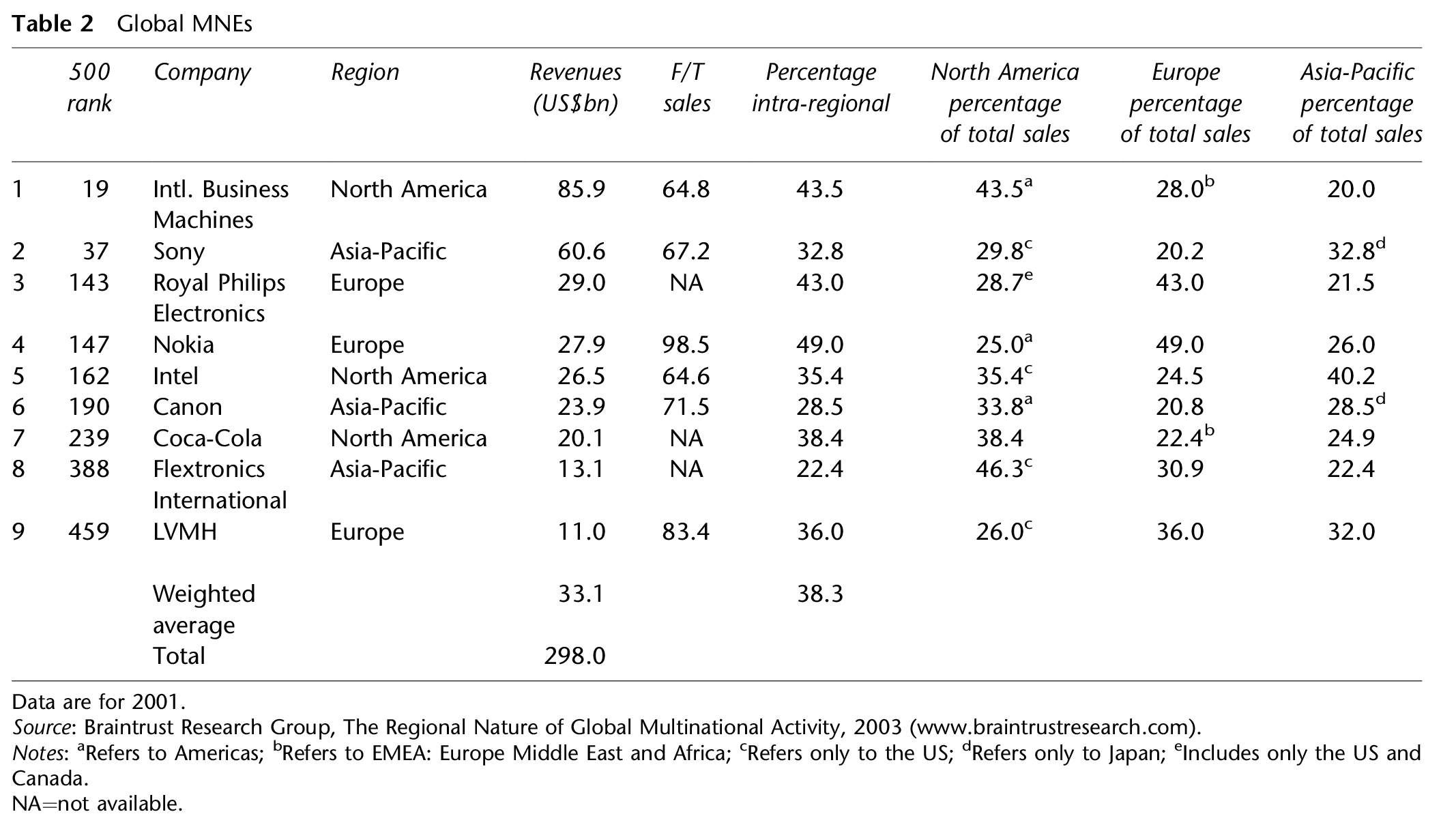

As a matter of fact, “few – if any – of the world’s largest firms command the capabilities to achieve, and to sustain over longer periods of time, a balanced, global geographic distribution of their activities and sales,” they write before citing a paper published almost two decades ago but still largely valid, in which Alain Verbeke and Alan M Rugman identified only nine “global firms” in the Fortune Global 500, defined as firms with a balanced distribution of sales across the world (i.e., having less than 50% of sales in their home region, and at least 20% of in each of the two host regions of the triad of North America, Europe and Asia). In subsequent work with Chang Hoon Oh, Alan M Rugman confirmed the quasi-absence of global firms with evenly distributed sales and assets across the world. In a more recent assessment of Fortune Global 500 companies, we had the opportunity to confirm – again – that if the number of global companies has increased, it remains a strong minority (around 30).

It thus appears there is a big gap between the discourses on corporate globalization and the reality of company activities in business. “For most of the cases, even for the largest companies, the relevant internationalization level is not the global scale but the regional one, as advocated by Pankaj Ghemawat in a recent book, among others. The permanence of this gap generates many myths around globalization, carrying big fears and many shortcuts like Bruno Le Maire’s arguments for the Alstom-Siemens case in the railway industry,” asserts Régis Coeurderoy before adding that there is indeed a Chinese company adequately-sized for the Chinese market and doing business the Chinese way, but almost only in China. And there is a big American company in the USA (GE) too. “But can we so easily infer from the addition of regional markets that we have got a global market? That is a shortcut, and a dangerous one for the real European consumer, who could be the local victim of this global myth!”

Myths often strive with the fact they tell convincing stories for unsolved problems. “The best way to deal with them is to develop further empirical studies on corporate globalization, building upon adequate firm-level data, and augmented with insight gained from senior management in the firms analysed,” the authors plead. “You can rest assured that these studies will mostly demonstrate the vulnerability, rather than the ferociousness, of the few global firms, the few born globals and the few truly global value chains, presently in existence…”

Campuses